modified business tax rate nevada

NRS 363A130 Allowable Credit 50 of the amount of Commerce Tax paid in the. Henderson Nevada 89074 Phone.

According to the court a bill that was passed during.

. The MBT rate is 117. Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses. On May 13 2021 the Nevada Supreme Court ruled that two revenue-raising measures enacted by the state in 2019 were unconstitutional because they.

Nevada Modified Business Tax Rate. However the first 50 000 of gross. 702 486-3377 MODIFIED BUSINESS TAX REFUND NOTICE Dear Taxpayer During the 2019 Legislative Session Senate.

But remember your business is still liable for federal taxes. In short in Nevada unlike many. Tax Bracket gross taxable income Tax Rate 0.

Effective july 1 2019 the tax rate changes to 1853 from 20. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries. Qualifying employers are able to apply for an abatement of 50 percent.

T 1 215 814 1743. The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter. March 31 2017 is 3000.

PdfFiller allows users to edit sign fill and share all type of documents online. Modified Business Tax has two classifications. The new Modified Business Tax rates for FY20 as calculated pursuant to NRS 360203 are 1378for general business and 1853 for mining and financial institutions.

In 2015 legislation was enacted to reduce both MBT rates if general tax revenues exceeded a. Modified Business Tax Changes and Refunds. Nevada Modified Business Tax Rate.

Effective July 1 2019 the tax rate changes. Ad pdfFiller allows users to edit sign fill and share all type of documents online. As we mentioned earlier there is no corporate income tax rate in Nevada.

10 -Nevada Corporate Income Tax Brackets. Nevada has no corporate income tax at the state level making it an attractive tax. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019.

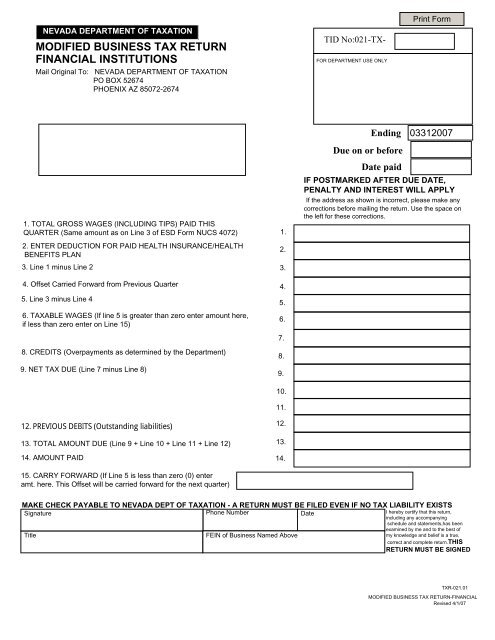

This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as defined by NRS 360A050. September 30 2016 is 3000. However the first 50 000 of gross wages is not taxable.

Since the passage of the Tax Cuts and. Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses. Assembly Bill 628 removed the sunset approved in SB.

December 31 2016 is 3500. 523 and the 063 tax rate was in place through FY 2009. The Department of Taxation confirmed it is developing a plan to reduce the Modified Business Tax rate for quarters ending Sept.

Nevada levies a Modified Business Tax MBT on payroll wages. There is one general rate 1475 percent and a higher rate for financial institutions 20 percent. Senate Bill 429 from the 2009 Session changed the.

Modified business tax rate nevada. Up to 25 cash back taxable wages for a calendar quarter are more than 50000 1475 tax on amount that wages exceed 50000. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages.

On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was. Tax Bracket gross taxable income Tax Rate 0. Imposition - A excise tax at the rate of 2 of the wages paid by the employer during a calendar quarter.

The Modified Business Tax liability before applying the Commerce Tax credit for the quarter ending. For example if the sum of all wages for the 9 15 quarter is 101 000 after health care and qualified veteran wage. 31 2019 through March 31 2021 for.

What Is The Business Tax Rate In Nevada

Does Qb Offer The Nv Modified Business Tax Payroll Form

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

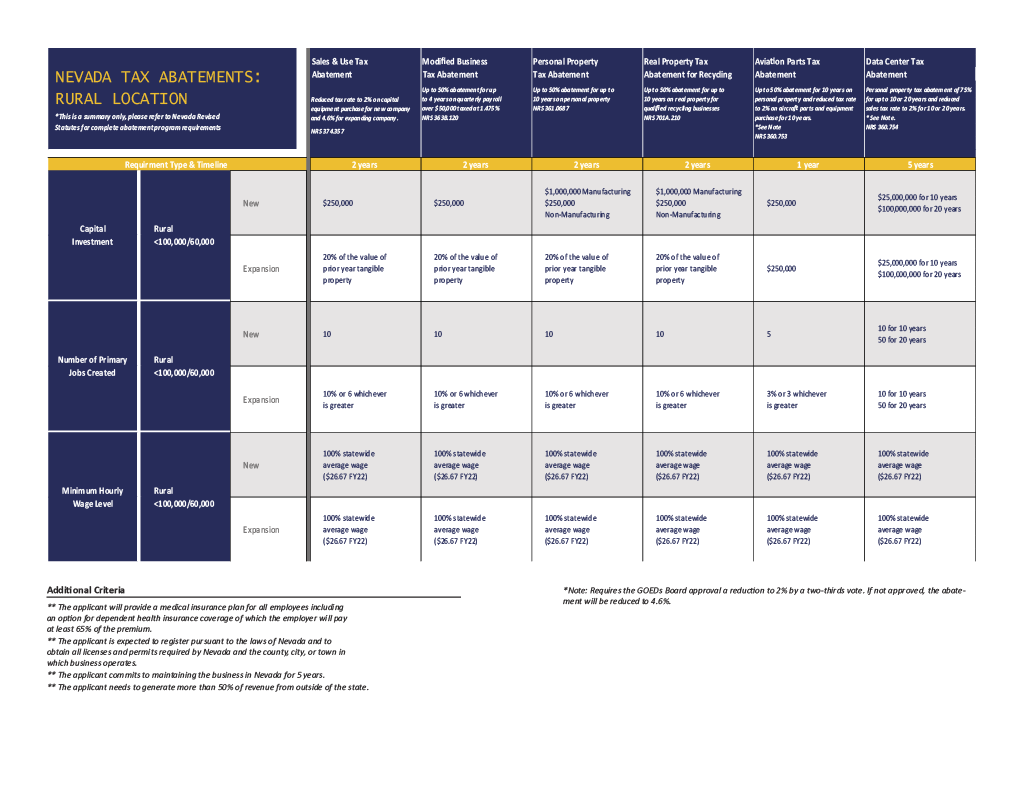

Business Friendly Nevada Northern Nevada Development Authority

Modified Business Tax Return Financial Institutions

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download